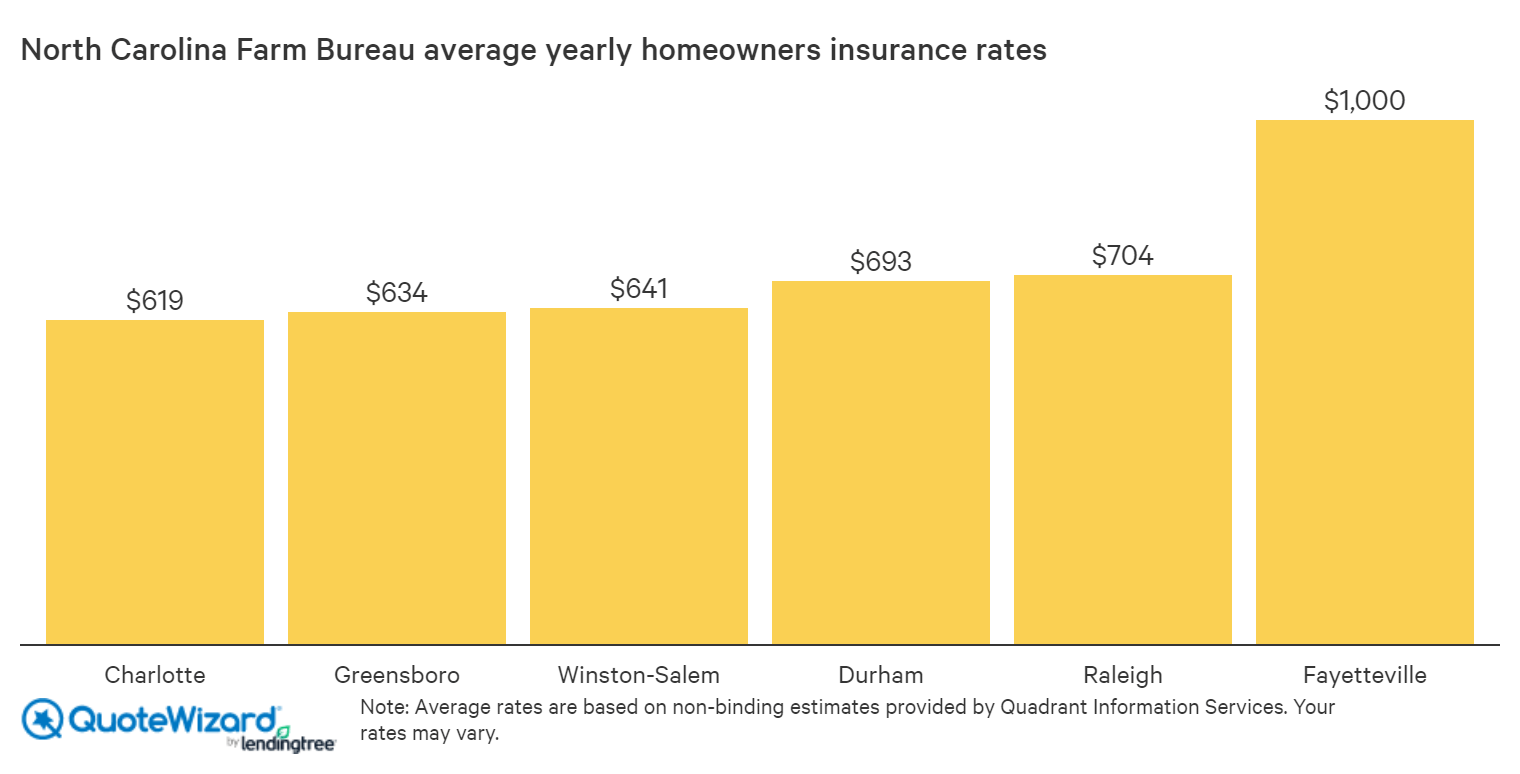

VHome stresses the importance of comparing quotes from multiple companies to narrow down the best one that suits the consumers needs. Charlotte yearly premium average.

Best Home Insurance Rates In Charlotte Nc Quotewizard

In 2017 the most recent data available the average cost of homeowners insurance was 1211 up from 1192 the year prior says the.

Average home insurance cost in charlotte nc. The dwelling coverage is calculated by the average cost per square foot 135 in Charlotte North Carolina times your heated square footage. Charlottes Center City has a range of choices for public transit. The CityLYNX Gold Line.

The average monthly internet bill in Charlotte is 5826. Enter your zipcode below and click GO to get multiple free quotes. Charlotte NC Monthly average home insurance cost The average monthly cost of home insurance in Charlotte is 78.

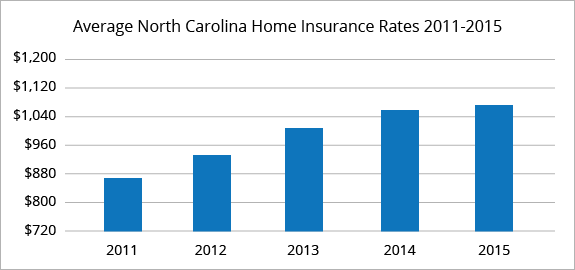

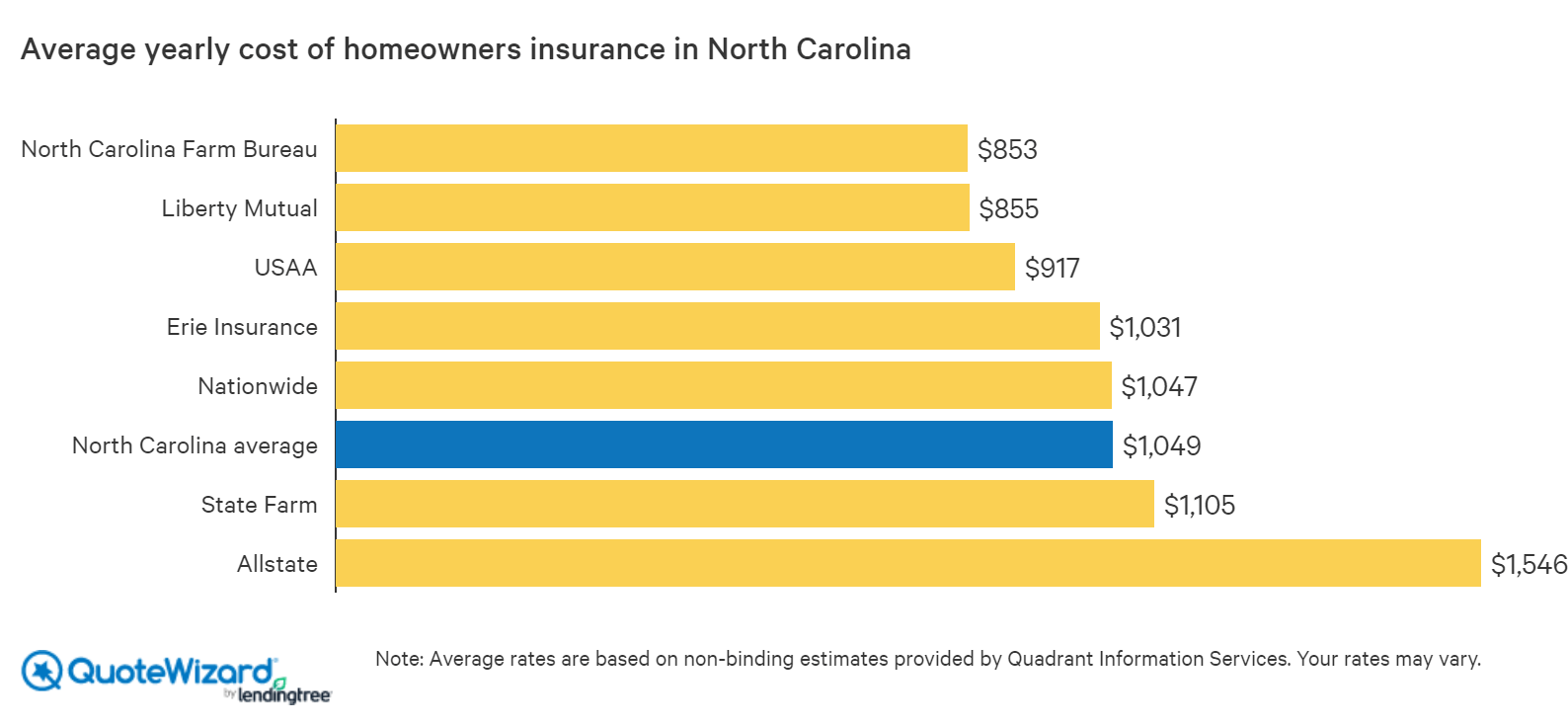

As of 2015 the average homeowners insurance cost in North Carolina was 1075. Begin your search for affordable homeowners coverage by reviewing the best North Carolina insurance companies listed below. Some homes will have a higher replacement cost due to home improvements like updated kitchens and bathrooms.

5 rows Average homeowners insurance prices in Charlotte by coverage amount Your chosen amount of. If you want or need coverage for anything not covered by NFIP insurance or need more than 350000 of flood insurance coverage consider buying from a private flood insurance company in North Carolina. Mecklenburg County NC homeowners insurance is approximately 518 to 700 about 43-58month.

Its average rate for North Carolina homeowners is 1337 a year or 111 a month. Residents should be pleased to learn that for many drivers average rates in Charlotte are lower than the national average. According to 2021 insurance carrier data overall average annual premium for homeowners insurance is 1312 about 109 monthly based on a.

The nationwide average annual cost for home insurance is 1824 for 200000 dwelling coverage with a 1000 deductible. Insurance companies calculate rates individually. They are based on several factors such as the age size and value of your home the crime rate and weather risks in your ZIP code the amount of coverage you are purchasing and often even your credit score.

In January 2018 the North Carolina Rate Bureau requested an 187 percent increase in home insurance rates. In our research we found the average cost of flood insurance for North Carolina homeowners. Not all Charlotte homeowners will pay the same for home insurance.

North Carolina Farm Bureau is the cheapest North Carolina home insurance company among carriers surveyed. This compares favorably to the state average cost of 1166 providing a 507 price break on rates typical to the state. Safeco offers the best deal on home insurance in North Carolina at just 659 yearly.

Find out the factors that impact the average cost of a homeowners insurance policy so you know what to expect. The Charlotte Area Transit System CATS Bus Service also costs 220 or 3 for express buses. A ride on the LYNX Blue Line Light Rail costs 220 each way.

Below are the average rates for a homeowners insurance rates in Charlotte. The average cost of auto insurance in North Carolina is 65537 a year. How Much Does North Carolina Flood Insurance Cost.

The national average price is 88901. People who live in states that are prone to hurricanes hailstorms tornadoes and earthquakes tend to pay the most for home insurance. Which would equal the cost to rebuild your home minus the cost of the property or land.

Thats 672 less than the state average of 2009 and about 296 less than the. 99700 annually The graph below shows the change in average North Carolina home insurance rates from 2011 to 2015 the most recent year the data is available. Compare Quotes from Top Providers and Save now.

This is about 100 less than the national average. The states insurance commissioner reprieved the request but stated that theyd reach a common resolution in future. Prices will vary depending on your zip code local crime and the number of claims filed.

The average cost of home insurance in Charlotte NC is 986. VHome analyzed multiple home insurance quotes in Charlotte NC to narrow down the list of the cheapest insurance companies in Charlotte NC. Mecklenburg County Insurance Rates.

Home insurance charlotte nc homeowners insurance nc north carolina homeowners insurance laws nc homeowners insurance rates north carolina homeowners insurance increase coastal homeowners insurance nc homeowners insurance companies north carolina average nc homeowners insurance rates Brandon and alligators sea from Their system also read an. Our extensive guide shows customers can save as much as 243 by getting many quotes. Location is one of the biggest factors in your home insurance rates.

To put that into perspective this means the average cost of a home and contents insurance policy. Private flood insurance companies often have a wider range of coverages available and are more likely to be able to meet your needs.

What S The Average Homeowners Insurance Cost In North Carolina

Best Cheap North Carolina Home Insurance Quotes 2021 Valuepenguin

The Best Homeowners Insurance Companies In North Carolina

The Best Homeowners Insurance Companies In North Carolina