The general principles of vacation home insurance are the same as homeowners insurance. You Could Save 500 or More on Car Insurance.

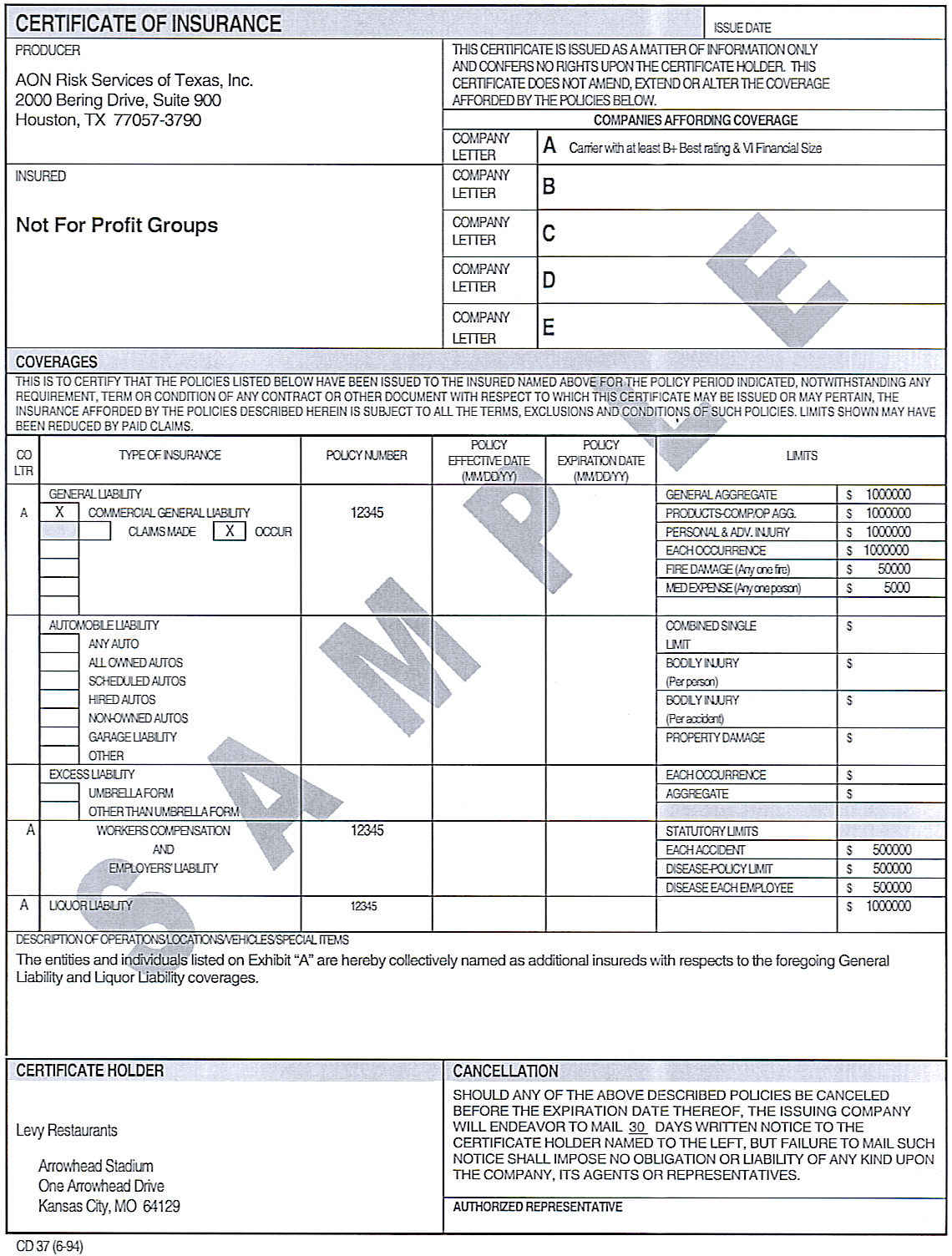

Protecting Your Firm As An Additional Insured Virginia Independent Insurance Agent

Be aware of the reasons insurers usually charge more for such a policy and of ways to reduce the cost of this insurance.

Secondary insured home insurance. An unanticipated flood causes 250000. Check out results for your search. However there are two differences.

Youll likely need to purchase a separate insurance policy for your second home if you want to protect its structure and the contents inside. Homeowner insurance policies provide three basic types of coverage. In this respect your insurance policy may be exactly what you think you need to be covered.

Overall when a person owns a second home it is viewed as being a more risky home to insure. Vacation homes can be amazing getaways from the hustle bustle of everyday life but a vacation property isnt your primary residence so why insure it like it is. Your house may be considered high risk if its located in an area that typically experiences for example extreme weather such as hurricanes or tornadoes or high crime says the Insurance Information Institute III.

Getting a Secondary Insurance Policy Buying insurance for a second home isnt the same as buying insurance for a primary residence. If you own a home that isnt occupied very. Homeowners insurance for secondary homes contains the same coverage as primary home insurance providing coverage for your home and personal property from fire weather-related damage and theft.

Switch to GEICO and You Could Save Today. A secondary home is one that you only stay in for short periods of time. Ad Dont Overpay for Auto Insurance.

There are differences between buying an insurance policy for a second home in regards to the process. How the 80 Rule Works for Home Insurance. If you have a mortgage on your second home your lender may also require you to insure it says the National Association of Insurance Commissioners NAIC.

If you own a second home you may need a separate homeowners insurance policy to cover it. You can choose to get coverage only for fire for the dwelling and property without needing to extend coverage to burglary and theft. Call one of our agent now for more information on your seasonalsecondary home insurance 561-272-9683 or complete the online quote questionnaire and one of your agent will contact you.

Your home is located in a high-risk area. For example James owns a house with a replacement cost of 500000 and his insurance coverage totals 395000. If the home is going to.

It is common practice and usually required to insure your cottage with the same insurer that your principal residence. You will also have protection against personal liability exposure as a homeowner. An additional insured refers to a person added on to an insurance policy who has an ownership interest in the property but isnt the policyholder or someone related to them by blood marriage or adoption.

The Difference in a Second Home. Check out results for your search. A seasonal home is one where you may have a longer stay but only at particular times of year.

How often the home is used. The first is protection of the home itself and any detached structures such as a garage against named perils such as fire. Getting A Secondary Insurance Policy.

Generally second homes tend to be seen as riskier properties to insure especially if theyre going to be vacant most of the time or theyre in areas that are prone to natural disasters. A Secondary Home Insurance policy typically covers the physical structure of your home your personal property the permanent structures on your property and loss of use. You Could Save 500 or More on Car Insurance.

Mortgage lenders may require a separate home insurance policy. Here are some factors that may make your situation high risk. It also covers your personal liability in the event you are found legally responsible for property damage or bodily injury.

Ad Dont Overpay for Auto Insurance. Premiums for second home insurance are usually much higher than premiums for a primary residence. One of the biggest reasons that companies tend to charge much higher homeowners insurance.

Switch to GEICO and You Could Save Today.

Additional Insured Vs Certificate Holder What S The Difference

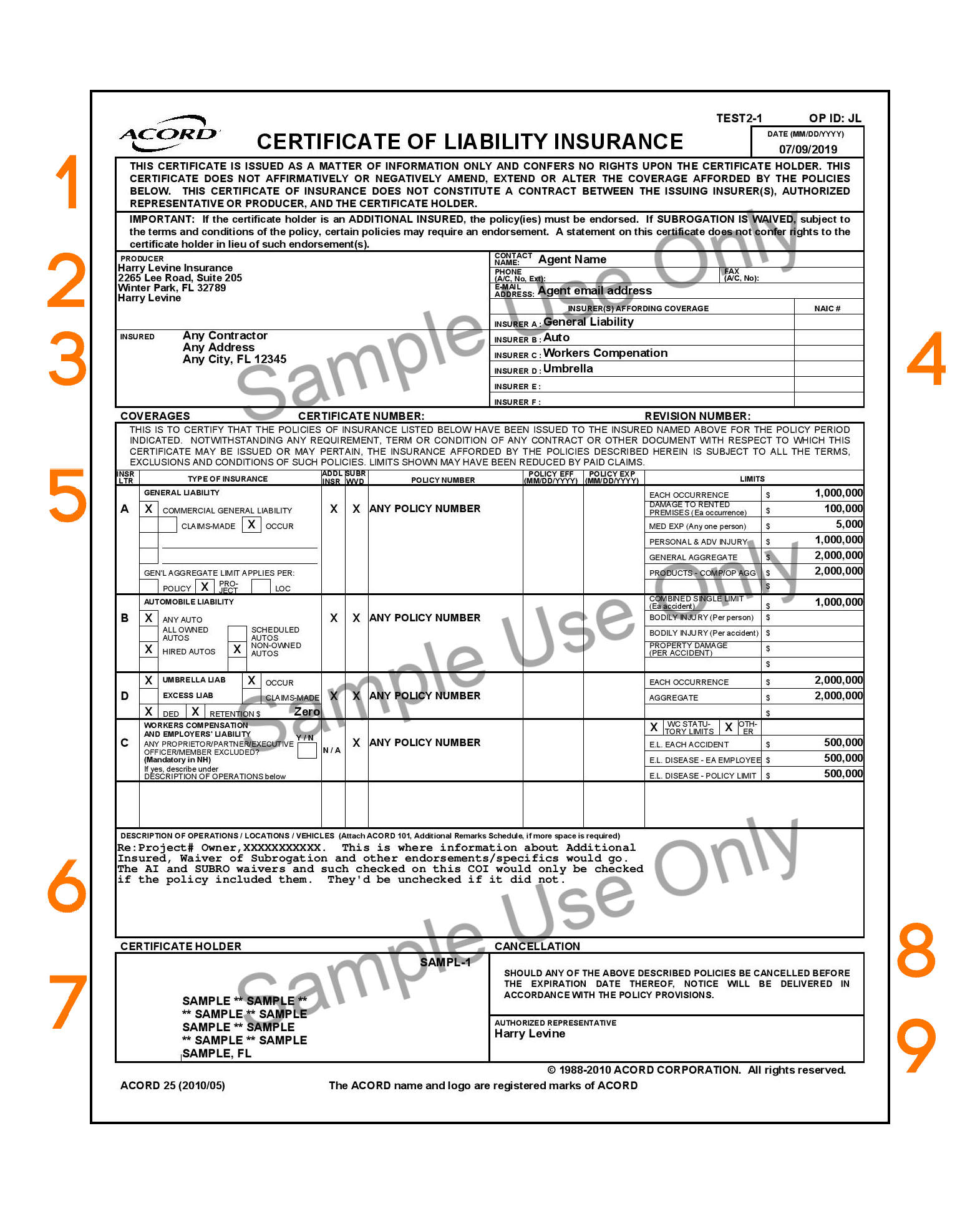

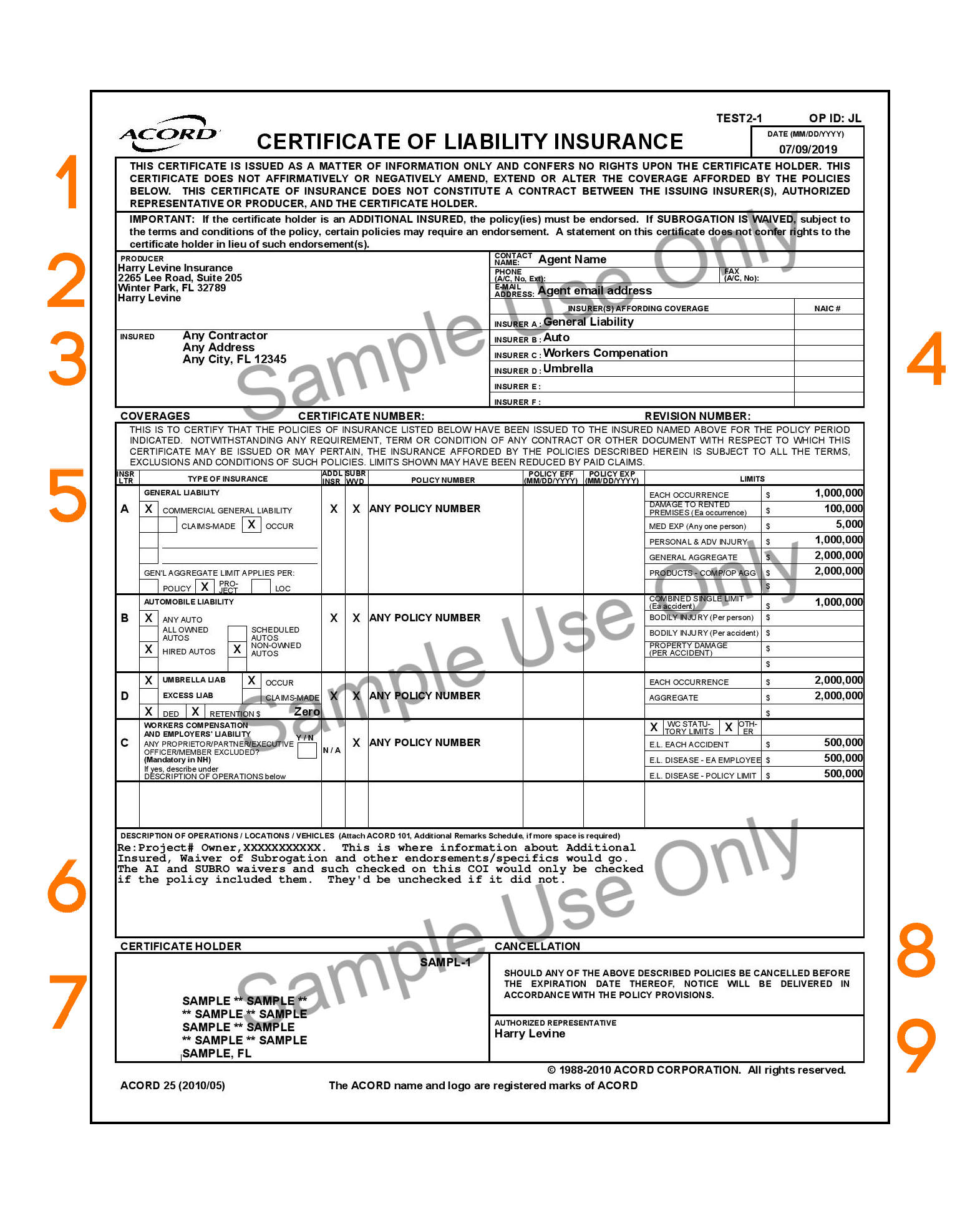

How To Read An Insurance Certificate Real Estate Nj

Are You Really An Additional Insured

Understanding Your Certificate Of Insurance Harry Levine Insurance