The average homeowners insurance deductible is 500. If you take on the risk of a 1000 deductible be prepared to.

A Home Warranty And Home Insurance What S The Difference

One is a fixed dollar amount which is the most common.

What should my home insurance deductible be. Remember the deductible you choose will affect your monthly premium the lower the amount of coverage you want the higher your premiums. The standard deductible on a homeowners policy is 500 to 1000. Homeowners insurance premiums are typically not tax-deductible.

However it can increase your financial burden in case you file a claim in your. Getting a loan for the repairs is not a good option and unfortunately accidents do happen. When the insurance company pays the claim it will be for the total amount of the damage minus the amount of the deductible.

An insurance policy with a percentage-based deductible will define a specific percentage of your homes insured value to be the deductible. Ask the Insurer What Deductible Amounts It Offers Limits on the amount of your deductible will be placed by your insurer as well. For example if your extended dwelling coverage is 200000 your insurer might give you 40000 20 for ALE.

According to the Insurance Information Institute most insurance companies will provide coverage for 50 to 70 of the amount of insurance you have on the structure of your home. You select an amount typically from 500 to 2500. Your deductible can be as low as zero or 500 but as high as 5000.

Thats a lot of money to front if something happens to your home. Whether or not you can handle an emergency and how likely you will need to use your homeowners insurance. You wont pay your deductible to the insurance company like a bill.

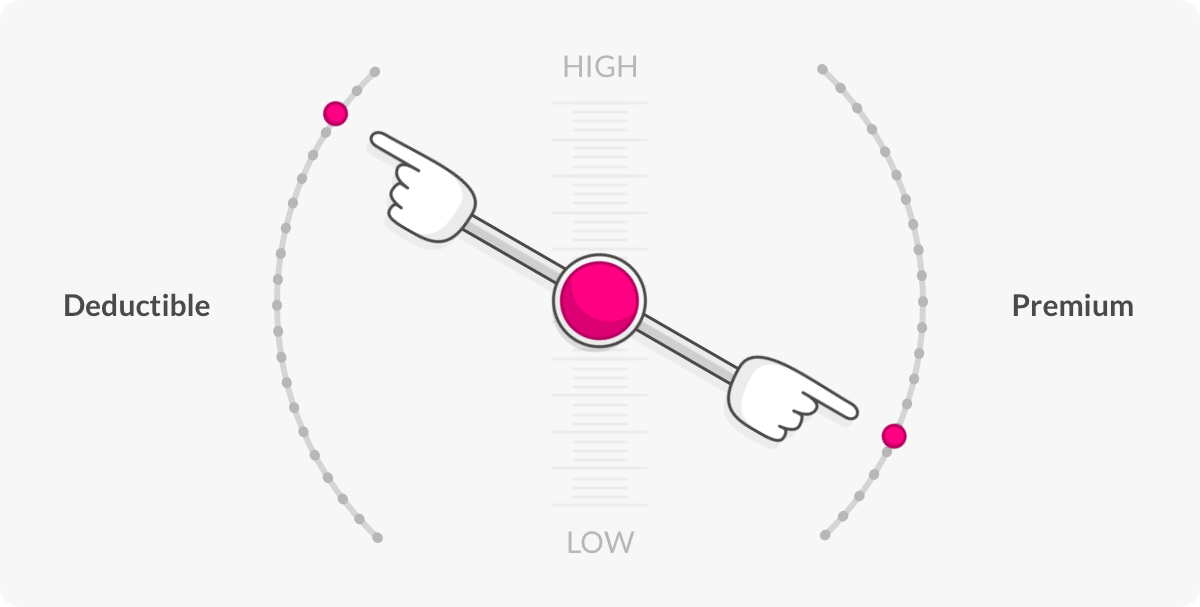

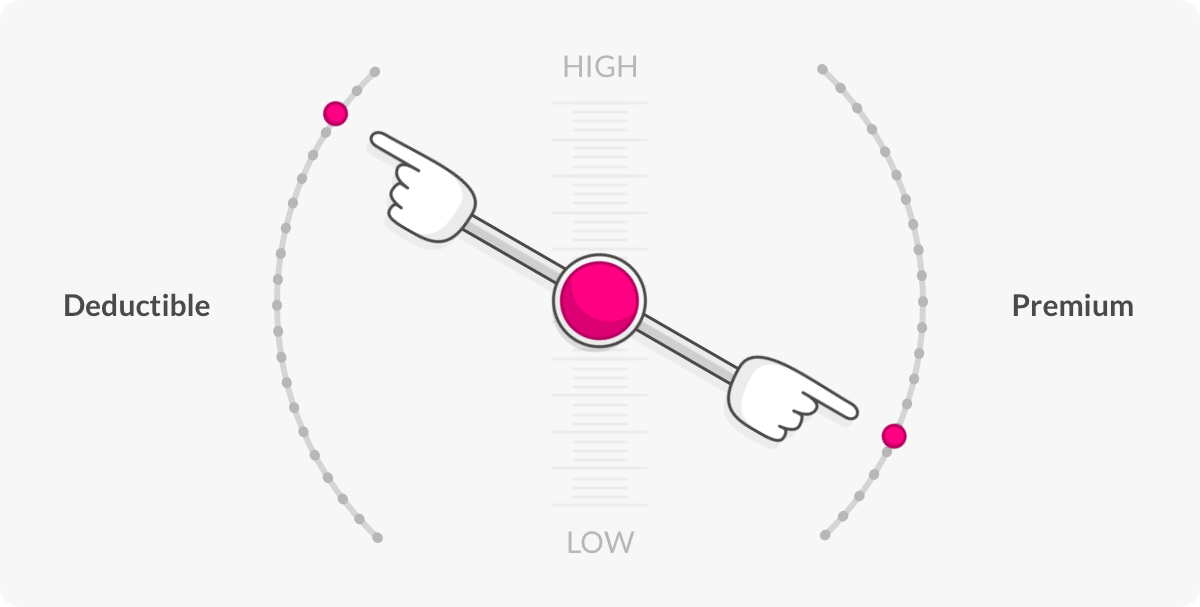

Your deductible should be the amount you are comfortable paying out of pocket in the case of damage to your home. A dollar amount deductible provides a clear way of determining how much is taken from a given claim. If you choose a higher deductible your premiums will be lower.

A deductible is the amount that you pay out of pocket for an insurance claim before your insurance company pays for the. If however you dont tend to hit things including other vehicles and you dont drive a lot of miles or visit areas with higher crime rates the higher deductibles could make sense for you. A home insurance deductible is an amount a homeowner pays out-of-pocket toward a claim before the insurer pays for the.

In general a higher deductible home insurance plan has a low premium amount. Usually a higher deductible means lower insurance premiums and a lower deductible means higher insurance premiums Most homeowners insurance. There are no deductibles for liability insurance.

A 1000 deductible is not going to be helpful to you if you do have a claim and cannot afford the deductible. For example if your home is 2500 square feet and 375 square feet 15 of your home is for a workspace you may deduct 15 of all your home-related business expenses such as. Most homeowners insurance policies use a percentage of your extended dwelling coverage to calculate your ALEusually between 2030.

Deductible is the fixed amount that you policyholder have to pay when making a home insurance claim. You select an amount with minimums often starting at 500 or 1000 and take that amount from every claim affected by the deductible. Taking that up to 1500 or 2000 can make a difference in your premium and will not likely raise any eyebrows with your insurer.

Lets say your policy. Types of home insurance deductibles Deductible amounts generally fall into three categories and are specified on the declarations page of your policy. The lowest deductible typically recommended by a home insurance company at the time of publication is 500 according to the Insurance Information Institute III.

We typically recommend 1000 as the minimum to maintain fair premiums but you may want to increase your short-term deductible to boost your long-term savings if youre financially secure enough to pay for a larger deductible out of pocket. In special cases however they might be wholly or partially tax-deductible as a. A homeowners insurance deductible is the amount of money a homeowner must pay out of pocket before home insurance coverage kicks in.

Your allowable homeowners insurance tax deduction equals the same square footage calculation you used for all other home-related business expenses. Usually these dollar amount deductibles can range from 500 up to 4000 depending on your policy and age of your home. Common deductibles run as high as 1000.

Insurance companies in high-risk areas will often ask you to have a deductible of at least 10 of the insured value. How high your deductible should be is determined by several factors.

How Do Insurance Deductibles Work Lemonade Blog

What Deductible Should You Pick For Your Auto And Home Insurance The Good News Is The Choice Is Yours Some Erie Insurance Car Insurance Insurance Comparison

What Is A Homeowners Insurance Deductible Valuepenguin

What Is A Homeowners Insurance Deductible Valuepenguin